The 9-Minute Rule for Financial Advisor Magazine

Wiki Article

What Does Financial Advisor Meaning Do?

Table of ContentsHow Financial Advisor Fees can Save You Time, Stress, and Money.The Single Strategy To Use For Financial AdvisorThe smart Trick of Financial Advisor Magazine That Nobody is Talking AboutThe smart Trick of Financial Advisor Near Me That Nobody is Talking AboutAbout Financial Advisor Job Description

You need to likewise consider how much money you have. If you're searching for an advisor to handle your money or to aid you invest, you will certainly require to meet the expert's minimum account needs. Minimums vary from expert to advisor. Some might deal with you if you have just a couple of thousand dollars or much less.

You'll after that have the ability to interview your matches to locate the ideal fit for you.

The 4-Minute Rule for Financial Advisor Salary

Prior to conference with an expert, it's an excellent suggestion to think regarding what kind of consultant you need. If you're looking for particular guidance or solutions, consider what type of financial advisor is a specialist in that location./financial-advisor-career-information-526017_v3-01-8def22beb8744989ab21839da3229c01.png)

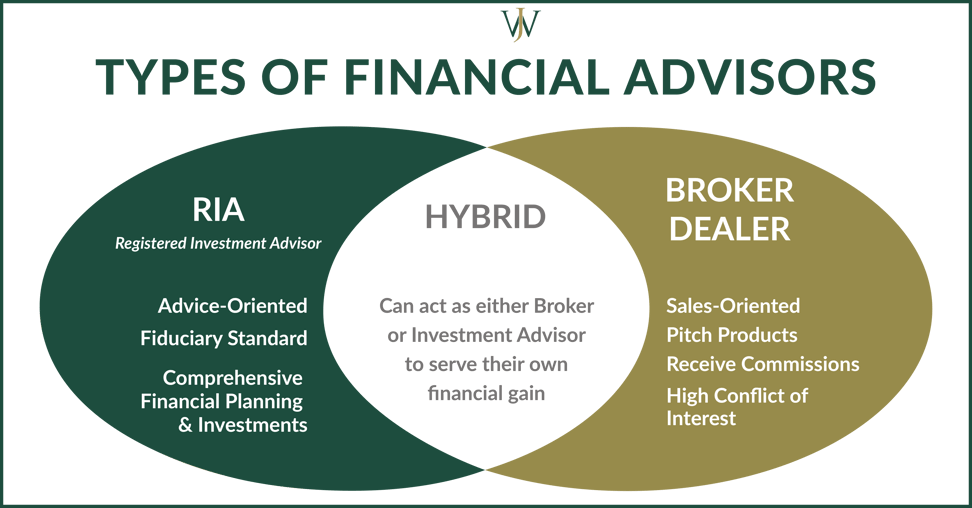

Which one should you collaborate with? We locate that, typically, people seeking financial guidance know to look for an economic expert who has high degrees of stability and also who wishes to do what remains in their clients' best passion in all times. It seems that fewer individuals pay attention to the alignment of their monetary consultant candidates.

The Only Guide for Financial Advisor License

Below's a take a look at four various sorts of consultants you are likely to come across and how they stack up versus each other in some vital areas. Armed with this details, you need to be able to better evaluate which kind is ideal matched for you based on factors such as your objectives, the complexity of your Get the facts financial situation and also your net worth.Let's take a look at each team. 1. Financial investment advisor. An excellent way to assume concerning the wealth monitoring pecking order is that it's dynamic, or additive. We start with the base. Financial investment advisors are outstanding economic specialists who do an excellent job managing moneybut that's all they do. While financial investment advisors offer a solitary solutionmoney managementthat one remedy can have several variants (from securities to financial investments in private business, genuine estate, artwork etc).

, one must initially obtain the required education by taking monetary advisor courses. Financial experts need to have at least a bachelor's degree, and also in some situations a master's is suggested.

The Greatest Guide To Financial Advisor Salary

Financial experts will certainly need this structure when they are recommending clients on minimizing their risks and also conserving cash. When working as an economic consultant, knowledge of investment planning might prove essential when attempting to create financial investment approaches for clients., such as transforming a headlight or an air filter, however take the automobile to a technician for big tasks. When it comes to your finances, though, it can be harder to figure out which jobs are DIY (financial advisor job description).

There are all type of financial pros available, with lots of various titles accountants, try this website stockbrokers, money managers. It's not constantly clear what they do, or what sort of troubles they're outfitted to deal with. If you're feeling out of your depth monetarily, your very first step must be to learn that all these different monetary professionals are what they do, what they bill, and also what choices there are to employing them.

Examine This Report on Advisors Financial Asheboro Nc

1. Accounting professional The major reason most individuals employ an accountant is to help them prepare as well as submit their income tax return. An accountant can assist you: Fill in your income tax return properly to avoid an audit, Discover reductions you could be losing out on, such as a residence office or child care deductionSubmit an extension on your tax obligations, Spend or give away to charities in means that will decrease your tax obligations later If you own a business or are starting a side organization, an accounting professional can do other tasks for you too.

Your accountant can likewise prepare monetary this website statements or records. Just How Much They Price According to the National Society of Accountants, the average price to have an accountant submit your tax obligations ranges from $159 for a basic return to $447 for one that includes business revenue. If you wish to work with an accountant for your service, the cost you pay will depend on the size of the company you're managing and the accounting professional's degree of experience.

Report this wiki page